Introduction:

Automated trading bots are revolutionizing the financial world by providing strategic and efficient methods for navigating the markets. If you’ve ever considered generating passive income or optimizing your trading strategies, building an automated trading bot could be your next step. In this article, we will explore how to develop your own trading bot, discussing technologies, strategies, and architectures involved. One of the architectures that reduces cost and saves time is serverless. Serverless is a cloud computing model that allows developers to build and run applications without managing server infrastructure, as cloud providers handle provisioning, scaling, and maintenance automatically.

By using an automated trading bot in your investment strategy, you can stay ahead of market trends with advanced algorithms and real-time data. Bots eliminate the emotional biases often present in manual trading, allowing for more disciplined and efficient trading. Additionally, their speed and data-processing capabilities enable them to capitalize on fleeting market opportunities that human traders might miss.

My Journey of Developing an Automated Trading Bot

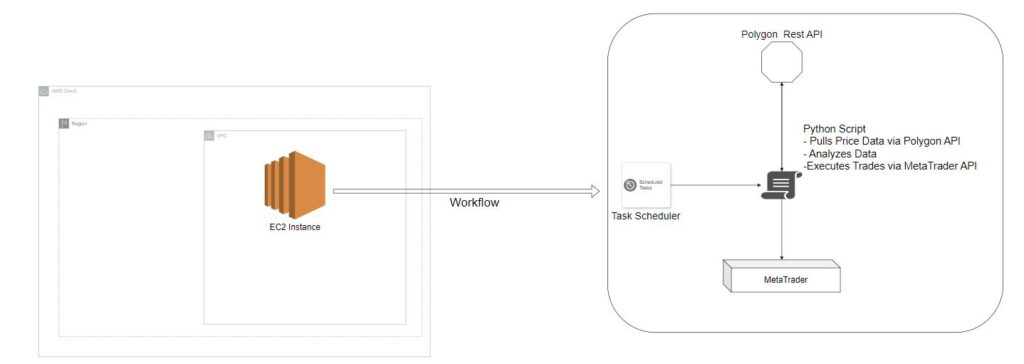

My journey started with a Python script running on an Amazon Web Services (AWS) Elastic Compute Cloud (EC2) instance. The bot operates every morning, analyzing market conditions and generating trade ideas based on its findings. Initially, I aimed for a risk-to-reward ratio of 4:1, which enables your bot to be profitable even if it loses the majority of the trades it takes.

Data Integration and Trading Platform

The bot relies on real-time market data from Polygon, a leading financial data API provider. The bot uses this data to make informed trading decisions and executes trades through MetaTrader, a widely-used trading platform for forex and CFD markets.

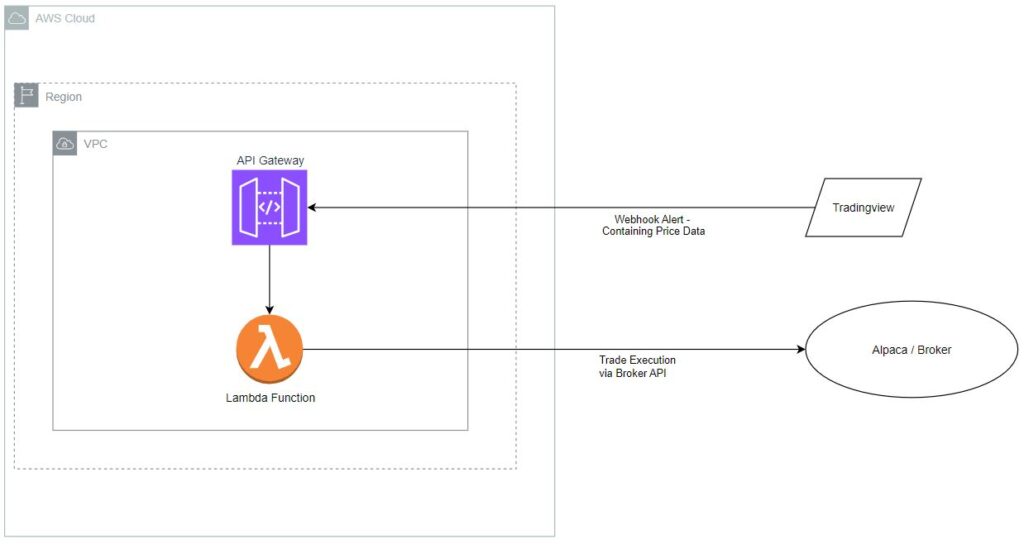

Alternative Architectures: Exploring Serverless Options

I discovered the potential of serverless architectures like AWS Lambda and API Gateway to enhance the bot’s efficiency. This approach allows real-time data processing and trade execution through compatible brokers such as Alpaca. However, the serverless approach also presents challenges, such as compatibility issues with MetaTrader due to its reliance on Windows operating systems.

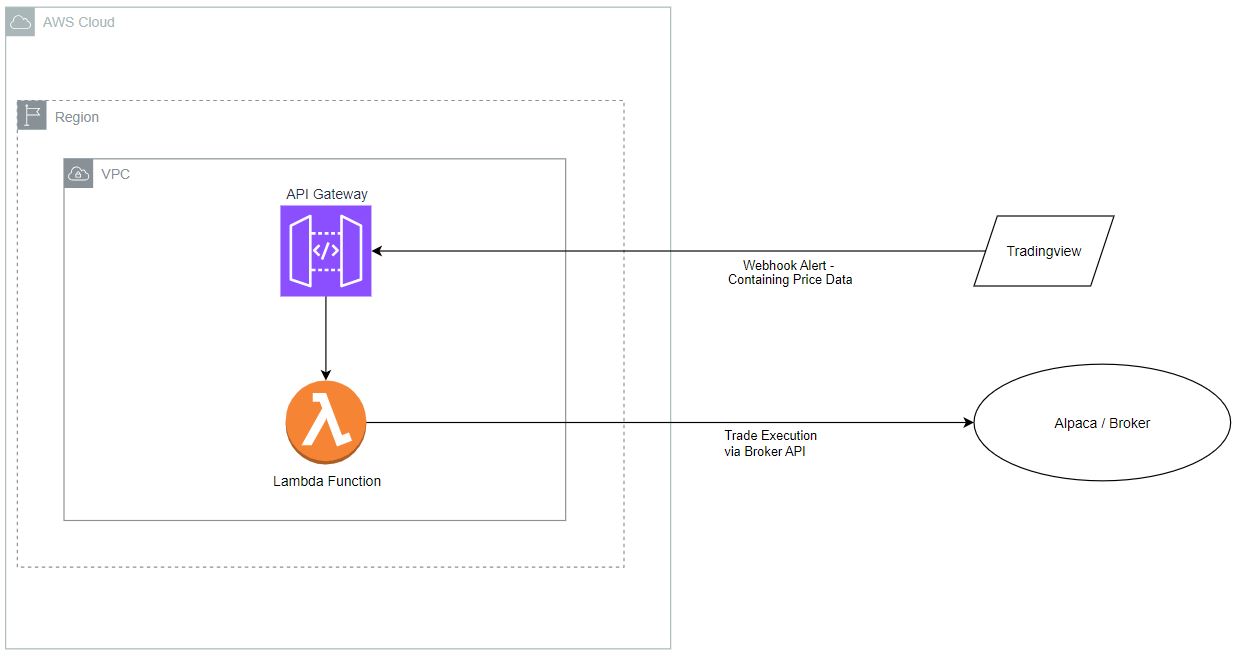

Pine Script and TradingView Integration

For a more versatile and cost-effective solution, I transitioned to Pine Script, a programming language specific to TradingView. This integration enables direct execution of trades on TradingView’s platform, reducing reliance on third-party data providers and brokers.

The Benefits of Automation

Automated trading bots offer several advantages over traditional trading methods. They remove emotional biases, process vast amounts of data rapidly, and capitalize on fleeting opportunities. These benefits contribute to more disciplined and efficient trading.

Challenges and Continuous Improvement

Building a successful automated trading bot requires overcoming challenges such as fine-tuning algorithms and adapting to market volatility. My dedication to continuous improvement and adapting to market changes has been essential in my journey.

The Future of Automated Trading

Automated trading bots are expected to play a more significant role in the financial markets as technology advances. Many institutions already use trading bots to assist professional traders. I plan to continue developing simple bots based on price action strategies while also exploring if time series forecasting using deep learning models can enhance the performance of these bots.

Conclusion:

My journey building an automated trading bot continues to expand my technical & financial capabilities. As you embark on your own bot-building journey, consider which architecture best suits your needs:

- Serverless: Offers cost-effective solutions that allow you to focus on code rather than maintaining infrastructure.

- TradingView Pine Script: An all-in-one solution that might take longer to set up and customize but provides comprehensive trading system management within TradingView.

- Virtual Server: Grants complete control over your system and compatibility with all brokers and data providers.

Next Steps:

For resources to start building your own trading bot, check out this GitHub repository: Simple Trading Bot Blueprint.

Leave a Reply